What is an iceberg order?

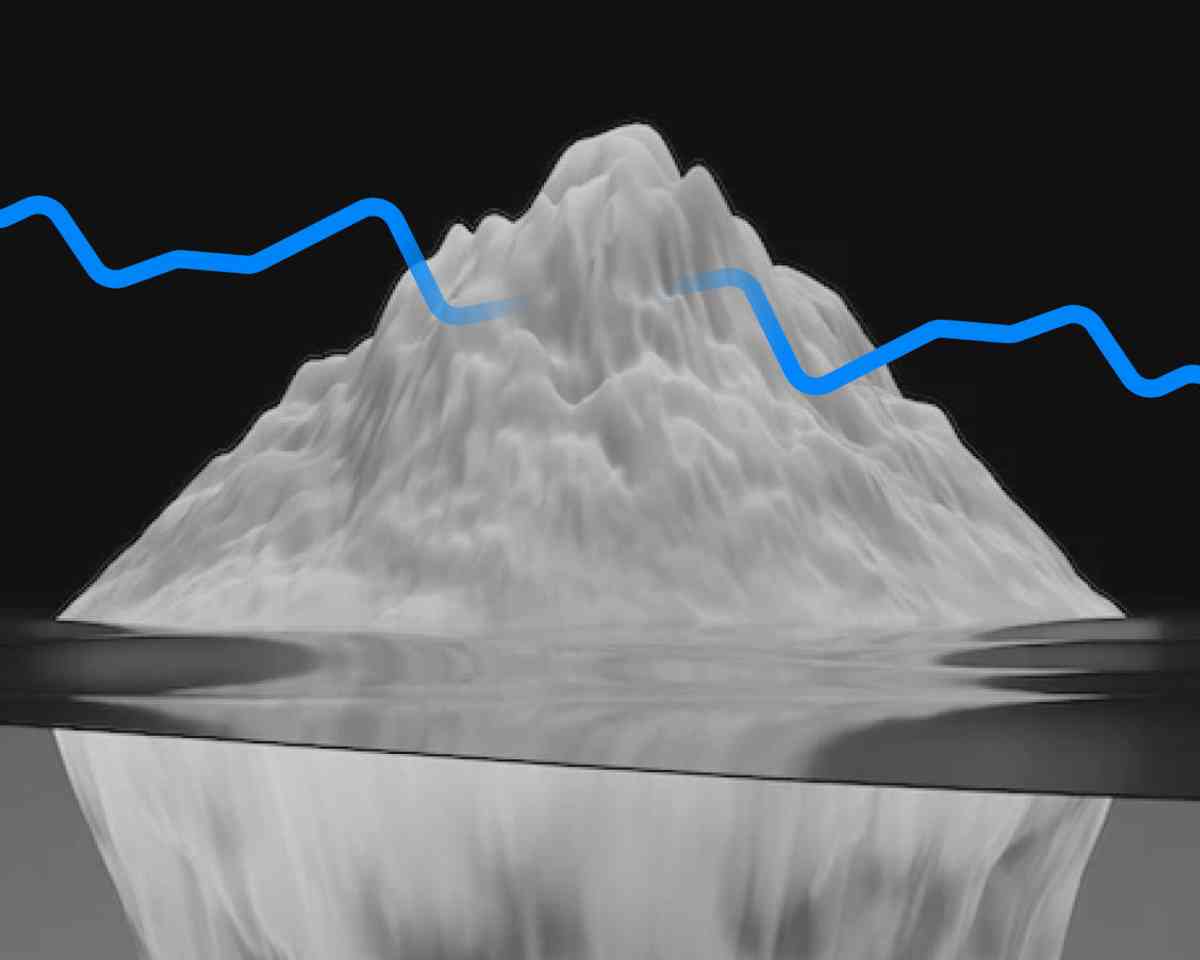

An iceberg order is a way for investors to buy, or sell large amounts of cryptocurrencies, without making a huge difference on the market. To achieve this, they divide their trading order into smaller chinks.

You have probably heard the term “the tip of the iceberg”. This is the reason, the order we are going to explain, is called an Iceberg Order, as the small transactions investors made are only the tip of the iceberg.

Why is that necessary?

Let’s say, for example, that an investor is buying or selling 100,000 Bitcoin at once. The transaction will stand out in the order books, and such a big change in the value of cryptocurrencies will disrupt the whole market, for the person placing the order, and for all the other traders.

That is why, when an investor wants to make such a big transaction, they divide them into smaller orders, which no one will notice, before the investor has executed the transaction.

The main reason why iceberg order is necessary is to avoid big changes in the crypto market, and price disruptions. Simply said, that is the way to prevent panic in the market. Transactions are based on a logistical plan, and are executed in a structured manner. That way, major changes are prevented in the cryptocurrency market.

Who uses iceberg orders?

Iceberg orders are most often executed by large investors, and market makers - firms or individuals, providing offers and bids. Usually, when we talk about big crypto transactions, we talk about institutional crypto investors, as they are the ones trading big amounts of crypto, and making an impact on the whole market.

How does it work?

As we already said, in an iceberg order, investors divide a large order into several smaller pieces, in order not to influence the demand or supply on the market.

The main goal here is to execute all the orders at the desired price. To identify an iceberg order, you will need to dig into level-2 order books. While Level 1 provides the basic price data, Level 2 provides much more information, showing the market depth up to 10 bids and offer prices.

Are Iceberg orders unfair?

As we explained, the meaning and the purpose behind Iceberg orders is to prevent big changes on the market. Small investors may look at this as an unfair movement, as they don’t have the power to influence the market this way.

While some exchanges implement policies to prevent price manipulation, it is still hard to tell if Iceberg orders represent an ethical dilemma, or not.

It is also important to say that iceberg orders are not a manipulation to the crypto market. They are just a strategy for larger investors to buy or sell big amounts of cryptocurrencies, without moving the price.

Although for some it may seem as an attempt to manipulate the market, it is not illegal, therefore, it is not a manipulation.

The important thing to say here is that both large, and small investors can use Iceberg orders to get a better price for their trades. It is not popular with everyone, but they are a legitimate way to trade cryptocurrencies.

Cryptoarbi is an automated cryptocurrency arbitrage platform. All you need to do here is choose the right subscription plan, and we will do the work for you!